I. Indian telco market

The enterprise segment is becoming one of the focus areas for most telecom operators in India. Apart from handling voice and data connectivity requirements of key corporates and banks, Telco’s are also managing their data center service requirements. Industry Experts claim that the operating margin in Enterprise business can be as high as 50%, compared to margins in the 30-35% range for traditional Telco services. The Indian enterprise data connectivity market is growing at 10% annually and annual revenue is expected to near the US$10 billion mark in the next 5 years. With most of the CSPs rolling out/in the process of rolling out 4G services, demand for 4G Enterprise services is only set to grow bigger.

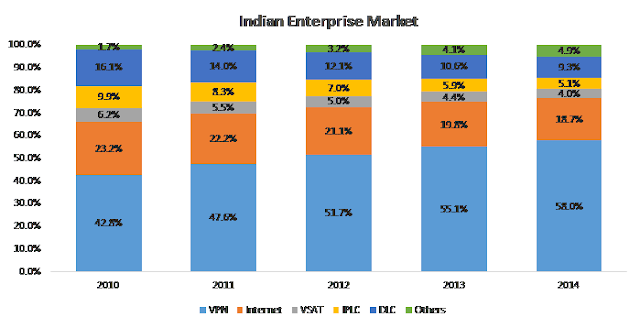

The landscape of Enterprise Services in India used to be fairly dominated by Voice and basic enterprise services around VPN, international private leased circuits, internet connectivity, national and international data connectivity. This was mainly due to lower maturity of market as well as lower operating costs for CSPs to provide enterprise services. However, in recent times, with telecom and IT converging, Value Added Services around managed services, enterprise voice solutions and network management & security services are provided by global operators (in partnership with Indian IT companies) are on a steady rise.

II. Enterprise Solutions Players in India

Market incumbents Bharti Airtel, Reliance Communications, Tata Communications have been in enterprise segment of the Indian telecom market, seeing healthy margins, as compared to voice services. Other notable players in the segment are Vodafone India and Aircel.

Aircel is the only operator currently that offers Enterprise Services through 4G. The parameters that will differentiate Aircel's 4G LTE services include customized offerings with a quick turnaround time for deployment of services to Enterprise customer, beating existing industry standards; high speed and low latency.

While competition among players has not been as intense in the Enterprise space as the Consumer space, it is believed that with new age technologies, opportunities around M2M, IoT and IT based infrastructure applications, Indian Telco Operators will have a competitive price/service offering in coming months.

III. LTE Challenges

Vendor Selection: Technical, financial, resources, schedule, supply chain, partnership

Handset/Chipset: Availability of dual mode CDMA/LTE devices

LTE CDMA Interference: Minimize the Effect on the CDMA network and RF (Radio Frequency) optimization

Antenna Sharing: DAS (Distributed Antenna System) between the two access technologies

Structural / site preparations: Timing and soft cost of eNB (Evolved Node) and RRH (Remote Radio Head)

Cell Edge Data Rates: Working applications at the cell edge including video

Cell Site Routers & Aggregation Routers: Testing Cell Site Routers and Aggregation Routers with eNBs

Backhaul: Upgrading to Ethernet backhaul to satisfy the traffic increase

OSS Performance: High quality operation of ePC (Evolved Packet Core) protocols; HSS (Home Subscriber Server) and PCRF (Policy and Changing Rules Function)

SON (Self Organizing Network) Implementation: Auto-integration of eNB and RF optimization

End User Quality: Network Quality perceived by the end user

New Market Launch: Launch new markets when an existing market is operational

IODT (Inter-operability Device Testing): Interoperability between handset and infrastructure

Standard Compliance: Different vendor interpretation & implementation of standards at bit level

Spectrum Clearing: Complete spectrum clearing in all AWS (Advanced Wireless Services) markets

Despite the large number of players entering the enterprise data segment, telecom licenses are voice-centric. Therefore, most regulations are voice-centric and do not cover issues related to enterprise service providers. Furthermore, Indian enterprise sector requires the ability to provide sophisticated IP-based and other data communications services to meet needs of enterprise and multinational customers. However, current ILD and NLD licenses were drafted before the development of current GTS services and technologies, and are largely premised on the provision of mass market consumer voice services. They also do not address the contracting and billing arrangements required by enterprise and multinational customers and do not clearly set forth licensee obligations regarding data services required by customers.

Considering the existing infrastructure in India, the deployment of LTE is going to be a big challenge for players With the wide variety of spectrum available for deployment (Band 3 (1800 MHz), Band 5 (800 MHz) and Band 40 (2300 MHz) LTE in the country will be very different from what we have seen in other developed nations like the US, Japan, South Korea etc. and more will have to be done to build a more conducive and growth-oriented domestic LTE eco-system.

More importantly, telecom operators would need to introduce attractive plans to get the potential users on board and further better their chances of increased revenues from non-voice services. Telecom operators have to spend considerable efforts to bring in awareness of LTE to the consumers.

IV. Insights from eTOM framework

The enhanced Telecom Operations Map describes all the enterprise processes required by a service provider and analyze them to different levels of detail according to their significance and priority for the business. The use of systematic business process frameworks as a basis for structuring the existing business processes (intra-enterprise integration) can have major benefits as it makes it easier to implement and deploy automated e-business channels for inter-enterprise integration. Much of the conceptual basis for extending the eTOM business process framework comes from integrating the frameworks used for B2B interactions. B2B implies a certain structure and discipline in the way that B2B transactions are structured, defined and sequenced. The key business problem for a CSP focusing on Enterprise services are:

· 'What processes does an organization have to put in place in order to deliver automated business-to business interface with its trading partners?'

· 'How to define the internal processes within an organization's jurisdiction and practically link them to public industry B2B processes defined by industry groups?'

The diagram below captures some of the key aspects of eTOM from an Enterprise business perspective:

Telecommunication is more than a utility, and a core requirement for every business. Telecoms can emphasize the importance of telecommunications management programs to secure competitive advantage for the enterprise.

i. Finance goals of growing top-line revenue, improving the bottom-line and delivering a positive ROI, can be aided by communication enabled technology. It can help receive real-time updates from the fields and minimize bottlenecks, to grow the business. Telecom Expense Management programs can reduce one of the top line-item expense, thus reducing the OPEX and improving employee productivity. TEM reporting can support compliance with SOX, by providing adequacy of internal controls relating to revenue and expenses.

ii. Technology deployments e.g. unified communications, cloud computing, mobility, M2M and IoT, can result in innovative business uses for long-term success.

iii. Digital operations team can leverage the data from communication programs to pioneer new ways to interact with the customers.

iv. Security team can utilize new communications technology to mitigate the security risk.

v. Information sharing, constant connectivity for mobile employees and access to business critical applications & data with fast processing time, can be fulfilled by a robust network infrastructure.

vi. Employee HR benefit package may include corporate mobile devices and services, and BYOD programs. Mobility and unified communications initiatives promote productivity.

vii. Competitive sourcing based on carrier performance e.g. billing accuracy, responsiveness to service requests etc., without long-term agreements with Minimum Annual Revenue Commitments (MARC) provisions that inhibit adoption of new technology; and timely implementation of new contract pricing, can provide cost-effective solution to meet the communication needs of the enterprise.

On future looking competency such as Cloud On cloud services, many analysts believe that telcos can offer a true cloud, totally controllable cloud, wherein network and IT infrastructure can marry together. Despite security-related apprehensions, government, BFSI and telecom sectors continue to focus on public cloud, believes IDC. 2014 will see IT ecosystem transition to third platform technologies of cloud, and mobility and to a lesser extent big data and social. It predicts influx of cloud and enterprise mobility technologies along with the associated changes in architecture and IT management.

VI. Key opportunity areas for 4G

The enterprise segment will benefit the most from fourth-generation (4G) services in the country, considering the high-bandwidth internet capability supported by such services. Multiple corporate applications can connect and work seamlessly using the 4G technology that offers high-bandwidth. Enterprises are going to demand faster turnaround of their processes and demand their applications connect in real-time. With 4G, business processes will be real-time, instead of batch processes before, which will change the IT complexity of an enterprise environment.

Vertical wise, Indian CSPs believe healthcare, education and manufacturing could be some big adopters of high speed 4G networks. IDC also states that transport, communications, utility, media and BFSI would be key driving verticals for enterprise mobility.

The figure below captures key industry-wise (including healthcare, retail, automotive, and service industry) business drives and impact areas for 4G LTE.

On future looking competency such as Cloud On cloud services, many analysts believe that telcos can offer a true cloud, totally controllable cloud, wherein network and IT infrastructure can marry together. Despite security-related apprehensions, government, BFSI and telecom sectors continue to focus on public cloud, believes IDC. 2014 will see IT ecosystem transition to third platform technologies of cloud, and mobility and to a lesser extent big data and social. It predicts influx of cloud and enterprise mobility technologies along with the associated changes in architecture and IT management.

Wireline and Broadband connection is yet to grow to its potential in India. There were 233.09mn wireless Internet subscriptions in March 2014, of which 440,000 were served by fixed wireless technologies such as Wi-Fi, WiMAX, point-to-point radio and very small aperture satellite (VSAT) terminals.

4G is way ahead of other competitive technologies in terms of applicability and performance. Cellular operators are already experiencing greater demand of data with excellent network quality and this is well poised to grow. Foreseeing this, more cellular operators are opting to bypass 3G and are moving towards 4G deployments.

Devices: Device rich strategy with inexpensive smartphones encourages adoption. By contrast, dongle-focused approach in some rollouts in Europe have triggered significantly lower subscriptions rates.

The figure below captures the success factors and inhibitors for a 4G launch:

VIII. Lessons learnt

Bharti Airtel launched India's first 4G service in Apr 2012, followed by Aircel in Jul 2014. RIL 4G roll-out is planned for 2016. Crucial lessons can be learned from 250 commercial 4G launch across 90 countries world-wide.

Competitive Pricing: It has the greatest impact on 4G subscription.

a) Unlimited Plans: can disrupt market and gain market share, but generate higher usage representing massive un-monetized data. Tiered plans with data sharing options are more sustainable.

b) 4G at 3G Price: can drive adoption by offering customers a free transition to LTE as long as they have a 4G capable handset and subsequently launching higher tiered plans.

Attraction & retention: operators need to recall the break-even points in 2G/3G transition.

a) Normalizing: industry ‘culture shift’ shows 80% of all handsets sold are LTE, and all come with LTE data plans as standard.

b) Reverse option: to return to previous contract with no complications, if LTE doesn’t live up to the expectations.

c) Bundling: of unlimited voice and text plans that include LTE data serves as a counter-strategy for Over-The-Top VOIP services e.g. Skype.

d) Sharing exclusive content: for streaming video and games, music subscription etc. as an optional add-on to 4G dongle or LTE package.

e) Better Billing: to provide data usage associated with specific application or download, and sufficient alerts before exceeding the data limits, to build the brand trust.

Coverage: Tipping point in subscriptions occurs when the operator offers services to around 75% of the population.

a) Rolling out base-stations quickly to cover a wide area

b) Advance plans for network crashes, which are fairly inevitable at times.

The figure below captures the success factors and inhibitors for a 4G launch:

IX. Potential Solutions

{Confidential}

X. Conclusion

A number of business applications and use-cases require reliable high-speed mobile data. 4G LTE is the key to the future low-cost, high-value offerings. Enterprises in India are aware of 4G’s potential and enthusiastic for adopting it. These opportunities come with new challenges; and a full enterprise mobility strategy is needed to capitalize on the promise of advanced mobility; an area that can be enriched with software industry's vast experience.

**************************************************************************************************

References and Further Readings:

The Business Benefits of 4G LTE (Arthur D Little)

Telecommunications Is Strategic (TEMIA)

First 4G LTE Network Launch in the Americas: Challenges, Opportunities, and Lessons learned (Ken Geisheimer)

4G Operator Strategies & the Key Lessons Learned (Omar Janabi)

The Five Laws of 4G Launch Success (Nokia Siemens Network)

Telecommunications in India (Euromonitor International)

Telecommunications Market and Game Theory (ZENG Jianqiu, FAN Hailan)

(Internal Research Paper By: Tanima and Mythraeyi)

No comments :

Post a Comment